War Crimes and Stock Climbs: Why Israel’s Economy Defies Collapse

If Israel’s economy is spiraling, why is its stock market soaring—and what does that say about the industries profiting from war?

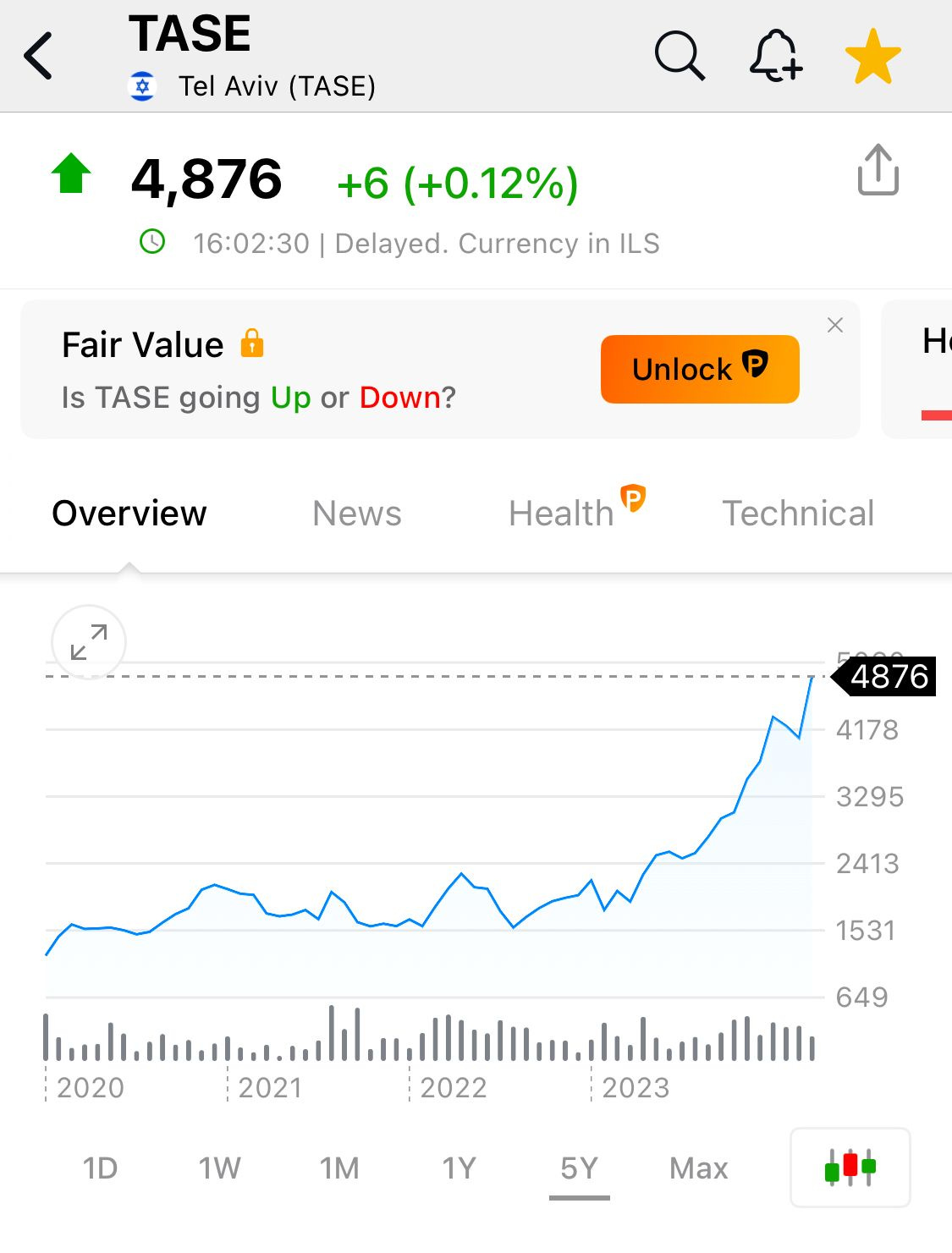

Israel’s economy is often framed as being on the brink of disaster—a collapsing credit rating, a “brain drain” of top talent, tech investors pulling out, and an unsustainable military budget. And yet, the Tel Aviv Stock Market Index is soaring, outperforming major U.S. indexes, even in the face of war crimes tribunals and international condemnation. The contradiction begs the question: How does an economy teetering on the edge of collapse keep hitting record highs? The answer lies in a well-oiled machine—one that profits from destruction.

The Military-Industrial Lifeline

Despite the country’s relatively small size, Israel is one of the world’s largest weapons exporters. In 2022, its arms sales reached $12.5bn, a 20 percent increase over the previous year. Israel’s economy is deeply entangled with its military-industrial complex, a fact Western media conveniently downplays. It’s not just about weapons—it’s a sprawling ecosystem that includes surveillance technology, cyber warfare tools, and AI-driven defense systems, all tested in real time on Palestinians before being sold to the world as "combat-proven."

Elbit Systems, Israel’s largest arms manufacturer, has seen its stock price climb steadily since October 2023. As the bombs fall on Gaza, its profits rise in Tel Aviv. Its American counterparts—Lockheed Martin, Boeing, and Raytheon—mirror this pattern, proving that the business of war doesn’t recognize borders, only dividends.

The Israeli stock market isn’t defying economic gravity;

it’s riding a tide of blood-soaked investment.

And then there’s the U.S. war machine, without which Israel’s military economy wouldn’t be able to function at this scale. The American defense industry thrives on arming Israel, and in return, Israel serves as a testing ground for the latest military technology. Surveillance drones perfected over Gaza soon find their way to U.S. border patrols, and AI-driven facial recognition systems used at Israeli checkpoints pop up in American policing. The pipeline of death is a two-way street.

The American Subsidy

The U.S. pours billions into Israel annually, not just in direct military aid but in economic and technological partnerships that keep the illusion of stability alive. While Israeli banks report capital flight, and the shekel remains volatile, American funds act as an economic shock absorber, ensuring that Israel can continue its war economy without immediate consequences. This financial support isn’t just about geopolitics—it’s about business. American weapons manufacturers, cybersecurity firms, and military contractors all have a stake in Israel’s ability to wage endless war.

War as a Business Model

Israel’s economy isn’t collapsing—it’s adapting. It has shifted into a wartime model where destruction is not a byproduct of conflict but an essential part of economic growth. Every missile fired is an opportunity. Every ruined building is a chance to test new weaponry. Every civilian killed is a statistic that strengthens military contracts.

Israeli defense companies boast about their “battle-proven” technology. Investors see an opportunity, not a crisis. Military expenditure is not a drain but a stimulus, ensuring a steady flow of funds into the arms industry. While GDP figures fluctuate, the war machine operates independently of traditional economic constraints, sustaining itself on blood and billions.

The “Too Big to Sanction” Phenomenon

Western nations have shielded Israel from the kind of economic consequences that would cripple any other state engaged in similar atrocities. The International Court of Justice has ruled on the plausibility of genocide, yet Israel faces no real economic repercussions. Instead, investors remain confident, knowing that the U.S. and Europe will do whatever it takes to maintain Israel’s financial stability.

Meanwhile, top Israeli economists acknowledge the growing instability:

"The war is unlike anything we have seen in the last 20 years in terms of the effects on the economy."

"Month by month we are badly surprised. We did not think that we would reach costs of about NIS 200 billion ($54 billion), and we are still in the middle of an unfolding event."

"We look much worse in the eyes of foreign investors than in our own."

Keep reading with a 7-day free trial

Subscribe to Ahmed's Perspective to keep reading this post and get 7 days of free access to the full post archives.